Products can be physical like shoes, apparel or computers, or they can be software platforms. As you move from year to year, a physical product line needs significant investments in manufacturing to refresh. And the process of determining what bets should be made to maximize that investment is critical. Software products need refreshes too, and although they seem pretty malleable, are also a complex undertaking. These challenges are enhanced in a global scenario. It’s critical to keep up with:

- Local market pressures: consumer/customer trends, innovation, competitive product parity

- Internal demands: budgeting, sales schedules, marketing calendars, inventory flushes

- Partner needs: Supply of material, manufacturing, distribution, tooling etc.

While technology systems, analytics and processes play a big role, I wanted to highlight today the need for what I call the “circles of collaboration”. Much like Google circles, but perhaps much more productive; J

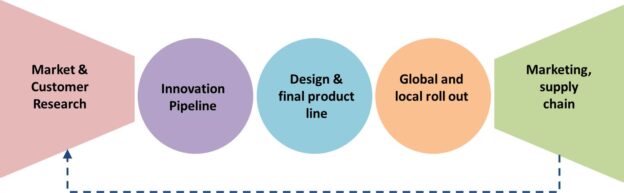

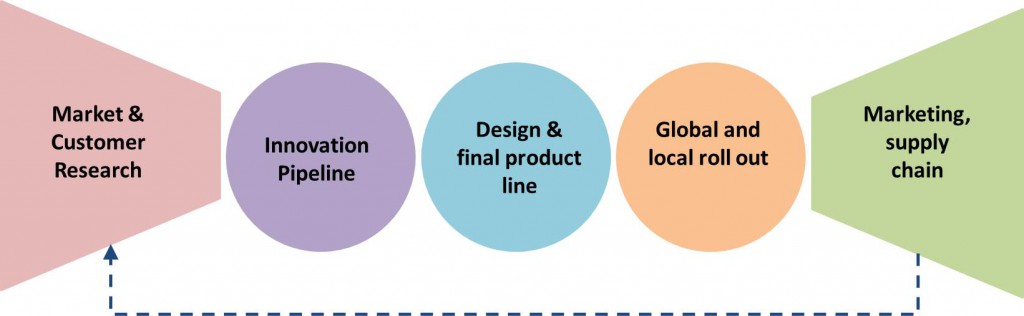

Product innovation and development happens in multiple groups or circles of stakeholders (an obvious observation I guess) . And the significance of these groups varies in scale and magnitude along the product lifecycle depending on where we are in the product cycle.

Of course, we all know that product lifecycle is iterative. At the very beginning, the collaboration circle that leads the innovation process includes heads of businesses, category product managers and the target markets. As research and market analysis yields gaps and points out white spaces, product concepts are born & qualified. Efficient and contextual collaboration at this stage leads to a healthy pipeline of the most viable product innovation candidates (both incremental and breakthrough). It’s critical that this circle is effective to minimize product drop ratios – concepts that do not finally make to production. It’s also important to maintain a healthy balance between new and carried over products. How we enable collaboration in this circle often delivers the most returns by way of competitive differentiation and market share. Am I going to be looking at the same, boring, slightly improved models from last year despite all the hype about the cool new innovations? Or am I going to be dazzled by an amazing new line? Coming to think of it, we don’t need to look beyond our cell phones to identify the Goliaths that have fallen recently.

The next stages of the product lifecycle elevate the circles that include design and prototype development to match the vision of innovation conceptualized in the first step. Leading from the first stage, effective collaboration through shared design boards extends continuous validation and sharing of common themes. Leveraging cost synergies, brand & market alignment and early recognition of the product shortlist is the goal of this circle. How fast you validate choices is critical to realize the “fail fast and move on” mantra.

Finally the final stages of the lifecycle again raise the market oriented circles to prominence leading to efficient go to market preparation, marketing, communication and sales strategies, feeding in turn the supply chain and distribution processes. In a connected world, it’s not as simple as it was 10 years ago. You can’t position something in isolation because YouTube and Facebook will immediately muddy the boundaries. Hence collaboration becomes extremely crucial to make the GTM strategy and product visions align well.

With this backdrop, the most important collaboration cornerstone that appears is context. What do the different circles need to effectively achieve their goals? For example, the first circle needs a robust mechanism to channel market needs, prior performance analytics and local competitive intelligence. This information when collated automatically provides patterns feeding into the innovation thought process. In an age when concept to shelf time is under constant attack, the circles of collaboration are essential drivers of success. The most important metrics I guess are the “concepts to product ratio”, “carried over” & “cross-category” synergies influencing cost, brand reputation and growth.

How we influence these metrics by providing the right information systems will determine both speed and quality of innovation.