In a research on consumer behavior, professors at Harvard found (1) that people who bring reusable bags to a store tend to spend more on organic food, and also spend a little more on indulgent items.

In a research on consumer behavior, professors at Harvard found (1) that people who bring reusable bags to a store tend to spend more on organic food, and also spend a little more on indulgent items.

The construct used was of “licensing” – when you do a good deed you feel good, and you permit yourself some excesses. Through a lot of effort, the researchers deduced – although with some caveats – this behavior of people who bring their own reusable bags.

We are all aware of techniques that retailers, and in general all sales and marketing, deploy to create customer engagement, and get them to buy more and more often. Some of these techniques are:

- Licensing – doing a good deed causes you to indulge

- Confirmation bias – you believe because you’ve seen it so many times

- Left digit effect – the $9.99 price effect where you believe it’s $9 when it’s actually $10

- The decoy – also presenting a less attractive option so you choose the one they want you to

- Price anchoring – showing a high priced item so everything else looks cheap

- Priming – seeding the sentiments in your head so you see the product in the same light

- And so on.

You can find these in any book based on behavioral science (Buyology, Predictably Irrational, Blink etc.). There are good blog as well tackling these topics and there is an excellent one at (5). These are very useful mechanisms to sell, and generate interest.

In fact, these mechanisms have been in use for ages. The only difference now is that neuroscience is confirming through sophisticated brain imaging what experienced sales people learned over time and practiced. And of course, scientists are making this learning available to all.

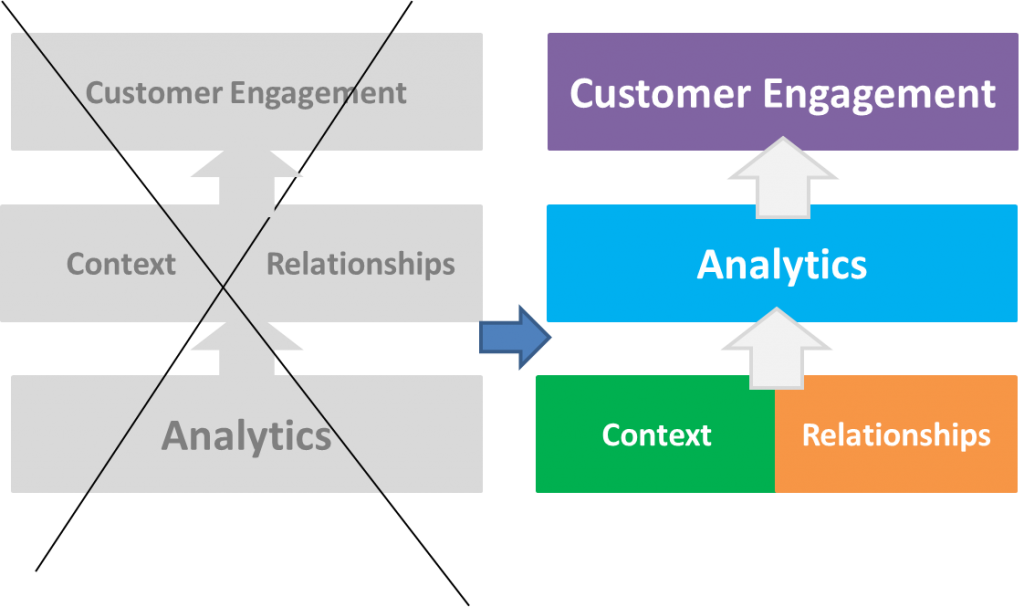

So how should we continue to use this research and deploy analytics for customer engagement? As the world becomes connected and more aware, there are 2 very important dimensions to this decision to begin creating long term customer engagement: relationships & context.

Both of these dimensions come first, and analytics steps in to help. Using analytics before these two dimensions is like old wine in a new bottle, and we’ll still be fighting the new game with the old rules.

First, such research doesn’t always shed much light on the context of the customer, although it tries to control for variables as much as possible. For example, the reusable bag study at Harvard did not indicate that it took into account the size of the shopping basket.

It is likely that when someone forgets a reusable bag, they tend to shop less and only for the items that are needed. Second, when people carry a reusable bag to the store, they are likely to go prepared for shopping, and organic food can be part of the shopping list of already highly conscious customers.

In addition, it’s likely that as you become older, you’re more affluent, more conscious of the environment, and probably have a family, thus leading to reusable bags and organic foods. It also follows that such a demographic may have indulgent foods planned into their basket anyway as “self control” or “reward” mechanisms which don’t surface when they forget their bags at home.

And even if the study took all these parameters into account, what does it tell us about customer engagement and loyalty? Who are these customers? What are their personalities?

Just like we won’t go asking people to gets their own reusable bags to the store based on this study, all such models must be implemented together with other initiatives to engage customers better with context. Sophisticated short term sales tactics such as these can take up a lot of time to plan, deploy and measure.

But in a world where customers have so much choice, and so much advertising thrown at them, engaging them is crucial to avoid being commoditized. Few people shop today in the absence of an ongoing promotion – in fact promotions are perennial. We are being primed to expect lower prices of our favorite brands. We also fear losing out to other shoppers. (shopper gamification – are we getting the best deal?).

In addition, customers are learning as well. The left digit effect of $9.99 is more effective in comparison with the price of another brand or model. Customers know not to trust our claims, and they constantly validate the discounts. The FREE checking account claim is scrutinized in more detail for other hidden fees before we jump in.

The term customer engagement was coined initially to record responses to a campaign – email opens, advt. clicks, offer redemption etc. But in today’s world, customer engagement has evolved beyond those one time activities. In a connected and conscious industry, we open ourselves to threats by innovative companies who can cash in on these very clever loopholes we think are unique to our business.

If we fail to create trust with our customers, we are vulnerable. The principles of neuro-marketing also place a heavy emphasis on trust, non-materialistic based relationship, and sentiment. Those are the ones we should aspire to first.

Second, with the advent of social and mobile, and connected devices, it is possible now to create one-to-one relationships that help pinpoint with high accuracy what the customer wants. For example:

- Maintaining context: A customer that browsed a mortgage product online, then opened an email on the same topic probably has a tangible need in this area. Marketing technology allows us to score and qualify this need automatically and intuitively. Our question then becomes of nurturing the customer’s journey and helping them make a choice that is right for them.

- Purpose: By engaging customers with insights and information that is centered around them – not our products – we become a reference anchor in their minds. Such customers will keep coming back to us throughout their decision making process, and price will become a secondary – although still important – factor. For a bank this purpose could be the high ground of long term financial security and well-being which allows them to bring the synergies of their products into play. Such customer purpose oriented themes are easily deduced for most categories, and customer segments.

- License to personalize: Analytics can make customers uncomfortable if done in a 1-way fashion. Instead we need to invite people into the community. Wish lists, trial users, social community participants, and other digital interaction tools are a key method to enable initiating these one-one relationships with customers. Not many established businesses have evolved in this direction so far. Analytics, when deployed on top of this personalized relationship can yield significant returns. To avoid gaffes such as by Target when they sent to a teenager’s home offers on maternity products(4), we need to establish 1-1 relationships based on trust and mutual consent.

Creating these personalized relationships that set the expectations on both sides lead to a dialog, in stark contrast to mass-marketing efforts focused on improving conversion rates through analytics. Both are needed at all times of course, but we have the tools now to shift the balance towards personalization.

Taking this concept a little further, personalized 1-1 relationships – not analytics driven statistics – can be extended by thinking of the customer’s entire persona outside of our own business.

For example, insurance customers may also have one or more of the following interests – fitness enthusiasts, cooking enthusiasts, sports coach, travel buffs etc. This allows us to establish multiple trusted relationships with the customer through those service providers as well. Some examples are:

- Risk management: Horizon Blue Cross Blue of New Jersey launched a program (2) where certain fitness center members receive discounts on their premiums based on their fitness activity.

- Customer retention and acquisition: Alfa-Bank in Russia gives customers additional savings if they exercise(3) and tracks the exercise automatically through new connected technologies to make it seamless for customers.

These cross industry relationships are just the start, and can be linked easily across many customer interest areas. The advantage of this personalized approach is that there is no reason to trick customers to help us build their profile.

These cross industry relationships are just the start, and can be linked easily across many customer interest areas. The advantage of this personalized approach is that there is no reason to trick customers to help us build their profile.

Social media has shown us that people willingly provide personal information for tangible benefits – in this case these benefits are convenience, experience and of course price. In fact, people looking for a product fill out online questionnaires and forms because they increasingly expect the selling company to present a personalized and tailored proposition.

If we engage customers as expected, we build trust leading to growth in perceived value and mind-share of our brand.

In a digital, connected world, we need to move forward in evolving our models of engagement. Analytics for customer engagement is great, but if we only use it to improve the same old methods of conversion based engagement, the threat of obsolescence is high.

In a digital, connected world, we need to move forward in evolving our models of engagement. Analytics for customer engagement is great, but if we only use it to improve the same old methods of conversion based engagement, the threat of obsolescence is high.

Think about our favorite brands that are disappearing because they focused on improving what they had, instead of taking the leap to the new models that were emerging. In fact, the sharing economy is already disrupting solid business models.

The time can never be more right to invest in customer context and relationships (along with reinventing ourselves of course).

Images are from HBCBS-NJ and PSFK, Photo credit: lauradinneen / Foter / CC BY.

References:

- http://www.marketwatch.com/story/shoppers-with-reusable-bags-buy-more-junk-food-2015-07-08

- HorizonbFit – https://members.horizonbfit.com/horizonbfit

- Alfa-Bank – http://www.psfk.com/2014/05/russian-bank-higher-interest-rates-fitness-tracking.html

- Target – http://www.forbes.com/sites/kashmirhill/2012/02/16/how-target-figured-out-a-teen-girl-was-pregnant-before-her-father-did/

- Roger Dooley’s blog – http://www.neurosciencemarketing.com/blog/