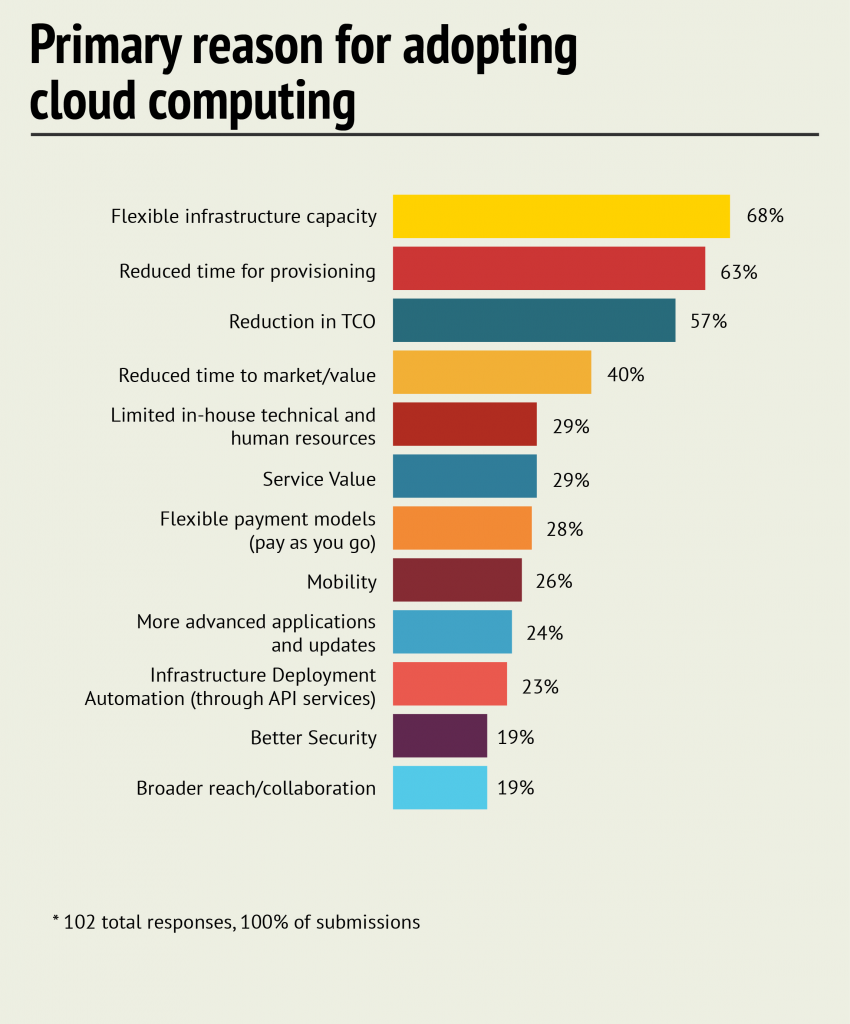

A recent multinational study by the Cloud Security Alliance showed that financial services firms are improving adoption of the cloud.

The top 3 reasons stated for cloud adoption in financial services were:

- Flexible infrastructure capacity (68%)

- Reduced cost for provisioning (63%)

- Reduction in TCO (57%)

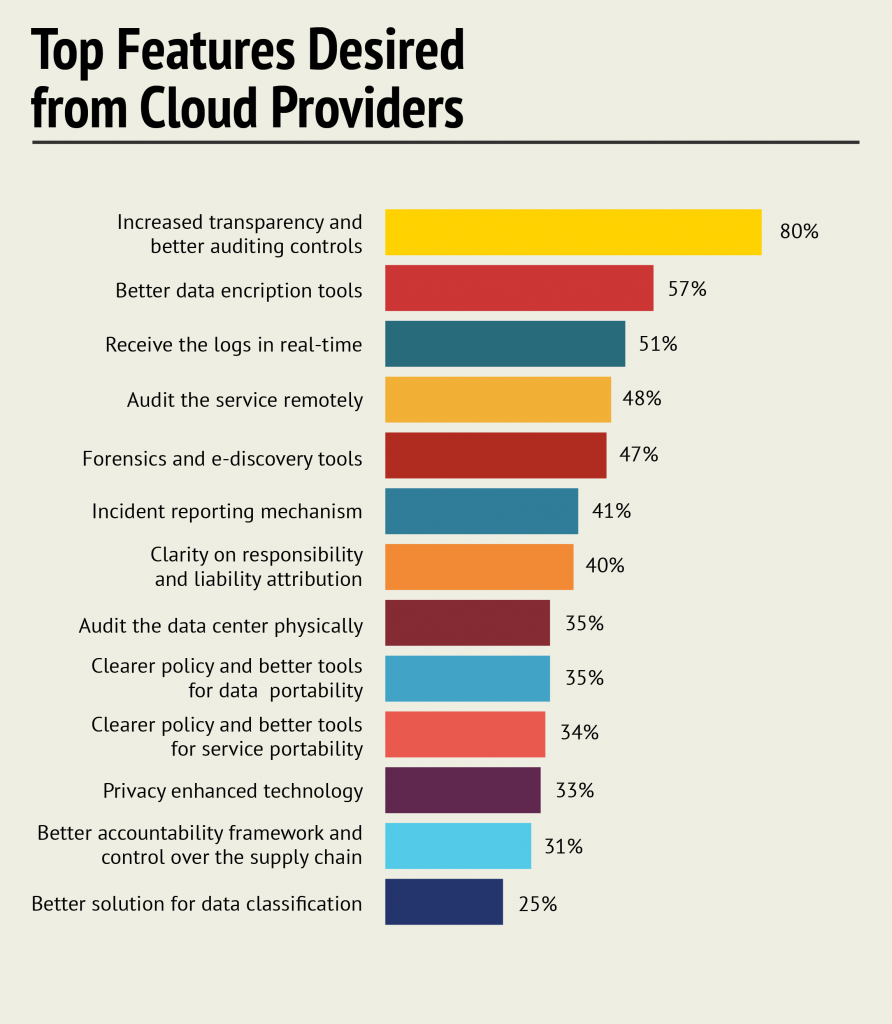

The top 3 wish-list items revolved around audit, compliance, forensics and encryption.

The top applications that were on the cloud were HR, email, CRM, application development / testing, content management / collaboration and disaster recovery / archiving.

Its clear that more education and awareness of the real benefits of the cloud are needed. Financial services firms are not apparently not realizing the gold mine they are sitting on, and the amazing innovation and customer engagement leverage they have through their early steps.

Taking the lead in customer engagement

We noted that CRM, big data, analytics and content management are the 3 capabilities high up on the cloud adoption list. And these are what you need today to truly create an engaging customer engagement ecosystem.

There is no other advantage that upstarts hold other than adopting the latest technologies and being more agile. Financial services firms have this already but the focus of cloud is getting lost in all the geek speak about security and compliance.

Fighting the industry disruptors

Lending, health insurance and mobile payments are three big disruptors in the market today. And Fin-Tech companies are leading the way with creating engaging experiences that use banks and insurers as back end providers.

With the adoption of cloud in the digital and analytics space, there is rally no reason for banks and insurers to give up this space. They have what they need, and the tools are never going to get better.

Its time to start focusing on building up the front end with customers, or get relegated to a commodity, money movement agency. And that privilege might disappear soon too.

What needs to be done urgently

- Remove business silos: Perhaps the biggest issue is that we are so slow at mutually-beneficial decision making. Every division of a bank or insurer will benefit by working with the other. The goal of customer 360 will only be met when divisions speak to each other to start reviewing the customer as a person. Large cloud and data management initiatives will yield only partial benefits until that is sorted out. And it needs to be done urgently. There is a reason why different divisions still have different CRM systems. And that’s the #1 impediment to maximizing the potential of you business.

- Remove channel silos: Every channel must talk to each other. But they seem to be growing apart with every passing day. In fact what is observed are digital islands within physical channels (digital kiosks within branches). Or branches using silo technologies like video conferencing with customers. The goal of channel silos are to work off a common data store. And investments by channels in individual solutions are not helping. Ask your branch software seller how they will integrate with the online systems, or call center systems. And vice versa. These are decisions that have big implications in the short term.

The images and the report by Cloud Security Alliance can be accessed here. Read the report to get excellent information on this trend. (https://cloudsecurityalliance.org/download/cloud-adoption-in-the-financial-services-sector-survey/)